Help For Underwater Mortgages Coming to End

Blog, Buying, Real Estate News | Dunham Stewart Earlier this year, President Obama signed a one year extension to the law known as the Mortgage Debt Relief Act, which was intended to help homeowners faced with an underwater mortgage. These toxic loans resulted from the housing crisis of the last few years. These homeowners typically owe more on the mortgage than the house is worth on the market. Even though we are seeing a significant percentage of owners elevated from this situation with the escalating home prices this year. For many the fact remains if they sold the property, they would still owe money to the lender. Many owners are working with their lenders to adjust the mortgage to reflect the property’s current market value. Before the relief law was passed in 2007, the IRS treated the amount of the mortgage forgiven or written off by a lender as income for the owner. Under the current law, qualified homeowners can avoid that problem. The applies to only primary residences, and the amount is limited to $2 million. If you think you might qualify, consult your real estate advisor and a tax professional before filing the paperwork. This program is only being made available until the end of the year and will not be extended any further, so act now or forever hold your peace.

Earlier this year, President Obama signed a one year extension to the law known as the Mortgage Debt Relief Act, which was intended to help homeowners faced with an underwater mortgage. These toxic loans resulted from the housing crisis of the last few years. These homeowners typically owe more on the mortgage than the house is worth on the market. Even though we are seeing a significant percentage of owners elevated from this situation with the escalating home prices this year. For many the fact remains if they sold the property, they would still owe money to the lender. Many owners are working with their lenders to adjust the mortgage to reflect the property’s current market value. Before the relief law was passed in 2007, the IRS treated the amount of the mortgage forgiven or written off by a lender as income for the owner. Under the current law, qualified homeowners can avoid that problem. The applies to only primary residences, and the amount is limited to $2 million. If you think you might qualify, consult your real estate advisor and a tax professional before filing the paperwork. This program is only being made available until the end of the year and will not be extended any further, so act now or forever hold your peace.

The luxury real estate market is showing healthy signs of growth compared to one year ago. For the first time since the Institute for Luxury Home Marketing began tracking upper tier market trends in 2008, its Market Action Index hit the threshold that separates buyer’s and seller’s markets earlier this month. The highest tier of homes for sale, has been the last part of the market to feel the effects of the housing recovery. On June 2, the ILHM reported its Market Action Index had reached 30 for the first time and in subsequent weekly reports the index has maintained its position. The Market Action Index (MAI) illustrates the balance between supply and demand using a statistical function of the current rate of sale versus current inventory. An MAI value greater than 30 typically indicates a “Seller’s Market” (a.k.a. “Hot Market”) because demand is high enough to quickly consume available supply. A hot market will typically cause prices to rise. MAI values below 30 indicate a “Buyer’s Market” (a.k.a. “Cold Market”) where the inventory of already-listed homes is sufficient to last several months at the current rate of sales. A cold market will typically cause prices to fall.

The luxury real estate market is showing healthy signs of growth compared to one year ago. For the first time since the Institute for Luxury Home Marketing began tracking upper tier market trends in 2008, its Market Action Index hit the threshold that separates buyer’s and seller’s markets earlier this month. The highest tier of homes for sale, has been the last part of the market to feel the effects of the housing recovery. On June 2, the ILHM reported its Market Action Index had reached 30 for the first time and in subsequent weekly reports the index has maintained its position. The Market Action Index (MAI) illustrates the balance between supply and demand using a statistical function of the current rate of sale versus current inventory. An MAI value greater than 30 typically indicates a “Seller’s Market” (a.k.a. “Hot Market”) because demand is high enough to quickly consume available supply. A hot market will typically cause prices to rise. MAI values below 30 indicate a “Buyer’s Market” (a.k.a. “Cold Market”) where the inventory of already-listed homes is sufficient to last several months at the current rate of sales. A cold market will typically cause prices to fall.

Only a year ago all the conversation was doom and gloom. Next we hear about the reviving housing market with talk of “green shoots”. Now it has become apparent that the real estate market is in a full upswing, with a rebound of 20% since the bottom of the downturn. However lately I have begun to hear talk of a housing bubble. Really, a housing bubble? Today’s market is driven by a shortage of supply, pent up demand and low interest rates. Not the abundant listings and lax lending standards as before. Lending standard remain stringent, and in the future the lack of easy money will act to temper any fever that may develop as prices rise. We tend to forget that real estate is cyclical. The market goes up and the market goes down. Right now the market is going up and should continue for several more years. Exactly how long is anybody’s guess.

Only a year ago all the conversation was doom and gloom. Next we hear about the reviving housing market with talk of “green shoots”. Now it has become apparent that the real estate market is in a full upswing, with a rebound of 20% since the bottom of the downturn. However lately I have begun to hear talk of a housing bubble. Really, a housing bubble? Today’s market is driven by a shortage of supply, pent up demand and low interest rates. Not the abundant listings and lax lending standards as before. Lending standard remain stringent, and in the future the lack of easy money will act to temper any fever that may develop as prices rise. We tend to forget that real estate is cyclical. The market goes up and the market goes down. Right now the market is going up and should continue for several more years. Exactly how long is anybody’s guess.

This is the year renovations make a come back according to the second annual

This is the year renovations make a come back according to the second annual  The Federal Reserve’s is buying mortgage-backed securities to keep mortgage rates low and that may be bolstering upper tier home values rather than helping to make homeownership more affordable for entry-level buyers. For decades home buying demand has reflected mortgage interest rates, but no more. One question that has baffled policy makers for six year is: Why haven’t housing markets responded to historically low mortgage rates? In fact, record low rates have had an impact, according to a new analysis by three contributing editors of Home Value Forecast, just not the impact that the Fed anticipated. Affordability definitely improves when mortgage rates are lower and yet the beneficiaries of these more attractive mortgage rates are not evenly distributed among households of all incomes and wealth. It is very likely that the top tiers of the owner occupied housing market are the ones benefiting the most from lower mortgage rates as this group has been less affected by credit score downgrades or more restrictive underwriting,” the economists said.

The Federal Reserve’s is buying mortgage-backed securities to keep mortgage rates low and that may be bolstering upper tier home values rather than helping to make homeownership more affordable for entry-level buyers. For decades home buying demand has reflected mortgage interest rates, but no more. One question that has baffled policy makers for six year is: Why haven’t housing markets responded to historically low mortgage rates? In fact, record low rates have had an impact, according to a new analysis by three contributing editors of Home Value Forecast, just not the impact that the Fed anticipated. Affordability definitely improves when mortgage rates are lower and yet the beneficiaries of these more attractive mortgage rates are not evenly distributed among households of all incomes and wealth. It is very likely that the top tiers of the owner occupied housing market are the ones benefiting the most from lower mortgage rates as this group has been less affected by credit score downgrades or more restrictive underwriting,” the economists said.

The percentage of home buyers writing offers in January increased by 12 percentage points according to Redfine and 23 percent of Americans think it is a good time to sell compared to 11 percent the same time last year, according to Fannie Mae’s January 2013 National Housing Survey results. The increase in homebuyer demand seen in January paired with a nation-wide inventory shortage has created an extreme seller’s market, bidding wars involving multiple offers have become increasingly common. There are two factors affecting upward trend in the share of home owners who say it’s a good time to sell. First, home prices are improving. Second, the number of homeowners who are underwater is declining, this eliminates a barrier for those owners who need to sell their home in order to buy.

The percentage of home buyers writing offers in January increased by 12 percentage points according to Redfine and 23 percent of Americans think it is a good time to sell compared to 11 percent the same time last year, according to Fannie Mae’s January 2013 National Housing Survey results. The increase in homebuyer demand seen in January paired with a nation-wide inventory shortage has created an extreme seller’s market, bidding wars involving multiple offers have become increasingly common. There are two factors affecting upward trend in the share of home owners who say it’s a good time to sell. First, home prices are improving. Second, the number of homeowners who are underwater is declining, this eliminates a barrier for those owners who need to sell their home in order to buy.

Going into 2013, home prices are expected to rise 6 percent driven by steady demand, lower bank-owned (REO) sales, and lower inventory of unsold homes. This is according to CoreLogic’s latest report. The CoreLogic Home Price Index (HPI) increased 6.3 percent in 2012, the largest increase and highest level since 2006. And year-over-year home price increases were more widespread. The two major drivers of improvement in the market have been the decline of real estate owned (REO) sales and less available inventory. The decline in REOs drove a sharp turnaround in home prices, but the impact of the decline will be less prominent in 2013. The major factor driving the market in 2013 is the lack of inventory. Current owners need to sell at prices high enough to extinguish their debt and provide equity for the next home purchase. Until home prices began to rebound in 2012, these borrowers had been effectively locked out and unable to list their homes for sale. The lock-out phenomenon, combined with the rise in investors converting foreclosures into rentals, led to a lack of for-sale inventory. These factors will continue to drive home prices rising in 2013

Going into 2013, home prices are expected to rise 6 percent driven by steady demand, lower bank-owned (REO) sales, and lower inventory of unsold homes. This is according to CoreLogic’s latest report. The CoreLogic Home Price Index (HPI) increased 6.3 percent in 2012, the largest increase and highest level since 2006. And year-over-year home price increases were more widespread. The two major drivers of improvement in the market have been the decline of real estate owned (REO) sales and less available inventory. The decline in REOs drove a sharp turnaround in home prices, but the impact of the decline will be less prominent in 2013. The major factor driving the market in 2013 is the lack of inventory. Current owners need to sell at prices high enough to extinguish their debt and provide equity for the next home purchase. Until home prices began to rebound in 2012, these borrowers had been effectively locked out and unable to list their homes for sale. The lock-out phenomenon, combined with the rise in investors converting foreclosures into rentals, led to a lack of for-sale inventory. These factors will continue to drive home prices rising in 2013

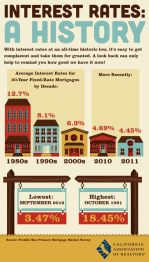

{Infograpic} Southen Californians might be worried about their tax rates going up, but at least they don’t need to worry about mortgage rates going up any time soon.We hit the all-time low interest rate for a 30-year fixed mortgage, reached in the week ending Thursday, according to Freddie Mac. The average 15-year rate slipped to 2.65 percent, also a record. Home prices are rising, in part because of reduced interest rates. Low borrowing costs have made refinancing more appealing and helped the housing market recover by making purchases more affordable. Check out this cool infographic.

{Infograpic} Southen Californians might be worried about their tax rates going up, but at least they don’t need to worry about mortgage rates going up any time soon.We hit the all-time low interest rate for a 30-year fixed mortgage, reached in the week ending Thursday, according to Freddie Mac. The average 15-year rate slipped to 2.65 percent, also a record. Home prices are rising, in part because of reduced interest rates. Low borrowing costs have made refinancing more appealing and helped the housing market recover by making purchases more affordable. Check out this cool infographic.

The real estate market is recovering but problems with a sizeable share of real estate appraisals also are holding back home sales.

The real estate market is recovering but problems with a sizeable share of real estate appraisals also are holding back home sales.