South Bay Vision – Market Update

Blog, Market Minutes, Market Updates, Real Estate News, Real Estate Tips | Dunham Stewart Encouraging news – The California Association of Realtors held their REALTOR ® EXPO in Anaheim the first week of October. Vice President and Chief Economist, Leslie Appleton-Young reported that with more available homes on the market for sale, California’s housing market will see fewer investors and a return to traditional home buyers as home sales rise modestly and prices flatten out in 2015.

Encouraging news – The California Association of Realtors held their REALTOR ® EXPO in Anaheim the first week of October. Vice President and Chief Economist, Leslie Appleton-Young reported that with more available homes on the market for sale, California’s housing market will see fewer investors and a return to traditional home buyers as home sales rise modestly and prices flatten out in 2015.

Here in the Beach Cities we are seeing record numbers of homes priced over one million dollars (approximately 30% this year) being purchased with cash. Up from 3.2% 10 years ago at this time.*

Please enjoy. Should your plans include real estate purchase and sales, please call or email with questions – and as always, thanks for your referrals!

To view full sources click >HERE<

Sources:

C.A.R. “2015 California Housing Market Forecast” October 2014

Paul Penzella /LA News Group, Daily Breeze, October 12th

The California Association of Realtors released their report on California existing home sales and median prices in July. The statewide median price rose over the 12 months ending in July by 7.1% to $464,750. Although June marked the end of the 23 months of double-digit prices increases, the median single-family home price in California has now risen on a year-over-year basis for 29 months.

The California Association of Realtors released their report on California existing home sales and median prices in July. The statewide median price rose over the 12 months ending in July by 7.1% to $464,750. Although June marked the end of the 23 months of double-digit prices increases, the median single-family home price in California has now risen on a year-over-year basis for 29 months.

Selling any home is a challenge. That’s been especially true in 2014, a year in which the number or existing-home sales has fallen. And if you’re selling a high-end luxury home, one with a price tag higher than $1 million? Then selling your home is even more of a challenge. Luxury home sales peaked in late June but by the first of September the market crossed over into a buyers’ market for the first time since early spring, though not strongly so. Median luxury prices also have been falling since the end of June, according to weekly market reports from the Institute for Luxury Home Marketing.

Selling any home is a challenge. That’s been especially true in 2014, a year in which the number or existing-home sales has fallen. And if you’re selling a high-end luxury home, one with a price tag higher than $1 million? Then selling your home is even more of a challenge. Luxury home sales peaked in late June but by the first of September the market crossed over into a buyers’ market for the first time since early spring, though not strongly so. Median luxury prices also have been falling since the end of June, according to weekly market reports from the Institute for Luxury Home Marketing.

While the term “luxury” can be subjective, a luxury home or luxury real estate is generally defined as a property priced within the top 5-10% of a given real estate market. In most markets that is a home of value of more then one million dollars in the Los Angeles market it’s defined by an entry-level price of about $2 million.

While the term “luxury” can be subjective, a luxury home or luxury real estate is generally defined as a property priced within the top 5-10% of a given real estate market. In most markets that is a home of value of more then one million dollars in the Los Angeles market it’s defined by an entry-level price of about $2 million.

According to the latest TrendGraphix reports for the beach cities for the period May 13th – July 13th compared to the same period last year you will see the number of properties for sale increased in Hermosa, Redondo and El Segundo however decreased slightly in Manhattan Beach. Although months of inventory have increased since the same time last year, we’re looking at approximately 1.9 months of available inventory for most of the beach cities including El Segundo.

According to the latest TrendGraphix reports for the beach cities for the period May 13th – July 13th compared to the same period last year you will see the number of properties for sale increased in Hermosa, Redondo and El Segundo however decreased slightly in Manhattan Beach. Although months of inventory have increased since the same time last year, we’re looking at approximately 1.9 months of available inventory for most of the beach cities including El Segundo.

One of the oddest things about this current housing market is the dwindling amount of supply. For areas like Los Angeles and nationwide, total housing supply has been on a downward trajectory since 2010. While an environment of rising home prices, less supply, and hungry buyers would lead you to believe that more home building would be occurring, not much of that has actually happened.Though the housing market is recovering nicely, it is not doing quite as well as some analysts had predicted. There has been no shortage of excuses offered as to why this is: the rise in interest rates, more stringent lending standards, the weather. However, we feel that there is one factor that is most responsible for curtailing the number of houses sold – the number of houses available for sale!

One of the oddest things about this current housing market is the dwindling amount of supply. For areas like Los Angeles and nationwide, total housing supply has been on a downward trajectory since 2010. While an environment of rising home prices, less supply, and hungry buyers would lead you to believe that more home building would be occurring, not much of that has actually happened.Though the housing market is recovering nicely, it is not doing quite as well as some analysts had predicted. There has been no shortage of excuses offered as to why this is: the rise in interest rates, more stringent lending standards, the weather. However, we feel that there is one factor that is most responsible for curtailing the number of houses sold – the number of houses available for sale!

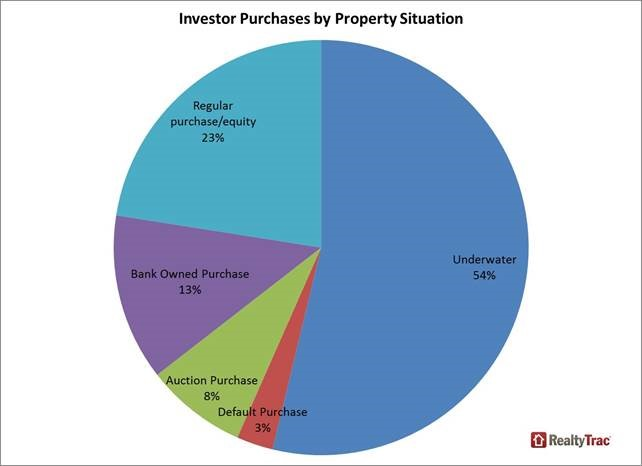

Though most real estate market observers have been predicting that rising home prices would drive investors out of the market for single family homes, that fact is that investors have purchased more homes than they did in all of 2012 or 2011. Investors have purchased more than 370,000 properties so far in 2013, which is already more than in either of the previous two full years according to a new investor insight report released today by RealtyTrac.

Though most real estate market observers have been predicting that rising home prices would drive investors out of the market for single family homes, that fact is that investors have purchased more homes than they did in all of 2012 or 2011. Investors have purchased more than 370,000 properties so far in 2013, which is already more than in either of the previous two full years according to a new investor insight report released today by RealtyTrac.

The red hot Redondo Beach housing market may be showing signs of a normal market. The median home price in July remained flat from last month. The slow down in appreciation came with a surge in the number of homes sold which indicates a growing supply of homes. 101 homes sold in Redondo Beach in July of this year compared with only 70 homes in July of 2012, an increase of 40%. The latest sales figures are the highest number of Redondo Beach homes sold in July since 2003. Sellers who had been on the sidelines waiting for better prices are now deciding it’s time to sell. If you noticed a lot of “For Sale” signs in the neighborhood, you were right. Even though interest rates have drifted upward, buyers remain anxious and homes are selling quickly, usually with multiple offers. I am working hard helping people make there real estate dreams a reality. Let me know if the time is right for you.

The red hot Redondo Beach housing market may be showing signs of a normal market. The median home price in July remained flat from last month. The slow down in appreciation came with a surge in the number of homes sold which indicates a growing supply of homes. 101 homes sold in Redondo Beach in July of this year compared with only 70 homes in July of 2012, an increase of 40%. The latest sales figures are the highest number of Redondo Beach homes sold in July since 2003. Sellers who had been on the sidelines waiting for better prices are now deciding it’s time to sell. If you noticed a lot of “For Sale” signs in the neighborhood, you were right. Even though interest rates have drifted upward, buyers remain anxious and homes are selling quickly, usually with multiple offers. I am working hard helping people make there real estate dreams a reality. Let me know if the time is right for you.

South Bay housing prices continued to climb in June, according to new statistics released by the South Bay Association of Realtors. The average prices of a single-family home in the South Bay increased 7.1 percent while the average price for a condominium or townhome jumped more than 29 percent, compared to one year ago. In June, the average price of a single-family home in the South Bay rose to $706,797 compared to an average price of $660,084 in June 2012. The average price for a condo or townhome in the area currently sits at $577,405 compared to $446,784 one year ago. Even though the report indicates that home inventory is in short supply which is helping increase housing prices, the South Bay housing market appears to be more stable than it was at this time last year. Data for June was compiled by the SBAOR using the California Regional Multiple Listing Service, Inc. (CRMLS). Cities surveyed included Carson, El Segundo, Gardena, Harbor City, Hawthorne, Hermosa Beach, Lawndale, Lomita, Manhattan Beach, Redondo Beach, San Pedro, Torrance, and Wilmington.

South Bay housing prices continued to climb in June, according to new statistics released by the South Bay Association of Realtors. The average prices of a single-family home in the South Bay increased 7.1 percent while the average price for a condominium or townhome jumped more than 29 percent, compared to one year ago. In June, the average price of a single-family home in the South Bay rose to $706,797 compared to an average price of $660,084 in June 2012. The average price for a condo or townhome in the area currently sits at $577,405 compared to $446,784 one year ago. Even though the report indicates that home inventory is in short supply which is helping increase housing prices, the South Bay housing market appears to be more stable than it was at this time last year. Data for June was compiled by the SBAOR using the California Regional Multiple Listing Service, Inc. (CRMLS). Cities surveyed included Carson, El Segundo, Gardena, Harbor City, Hawthorne, Hermosa Beach, Lawndale, Lomita, Manhattan Beach, Redondo Beach, San Pedro, Torrance, and Wilmington.

Young, first-time buyers are struggling to purchase a home. With low inventories of homes for sale, young first-timers are finding themselves competing against other bidders who are willing to pay cash. Meanwhile, many young buyers are having trouble qualifying for a loan, often due to high student loan debt. The number of first-time home buyers has been steadily falling in recent years. In May, first-time buyers accounted for 28 percent of existing-home purchases — a drop from 34 percent a year ago, according to NAR. Overall, young buyers have been left out of the housing recovery more than any other age group, according to a new USA Today analysis. The home ownership rate for 25 to 34 year olds has gone from 46.7 percent in 2006 to 29.7 percent in 2011 — a decline of 7 percentage points. The median age of first-time home buyers was 31 in 2012, according to National Association of REALTORS® data. As comparison, the 45-54 age group has seen home ownership rates fall 3.8 percent. First-time home buyers are viewed as critical to a healthy housing market, allowing older Americans to purchase their next home and helping to stimulate new-home construction.

Young, first-time buyers are struggling to purchase a home. With low inventories of homes for sale, young first-timers are finding themselves competing against other bidders who are willing to pay cash. Meanwhile, many young buyers are having trouble qualifying for a loan, often due to high student loan debt. The number of first-time home buyers has been steadily falling in recent years. In May, first-time buyers accounted for 28 percent of existing-home purchases — a drop from 34 percent a year ago, according to NAR. Overall, young buyers have been left out of the housing recovery more than any other age group, according to a new USA Today analysis. The home ownership rate for 25 to 34 year olds has gone from 46.7 percent in 2006 to 29.7 percent in 2011 — a decline of 7 percentage points. The median age of first-time home buyers was 31 in 2012, according to National Association of REALTORS® data. As comparison, the 45-54 age group has seen home ownership rates fall 3.8 percent. First-time home buyers are viewed as critical to a healthy housing market, allowing older Americans to purchase their next home and helping to stimulate new-home construction.