POLISHED *Market Update*

Blog, Buying, Community News, Dunham Stewart, Market Minutes, Market Updates, Real Estate News, Real Estate Tips, Selling | Dunham Stewart

We are now seeing record high selling prices for homes in many markets of California and the nation.

The sky high home values that seemed unbelievable back in 2007 have now been eclipsed in many of the larger markets of the state. The markets in the Bay Area now boast the highest values and record fast sell times.

Demand Conditions

- Employment is strong throughout the state. In all coastal counties, the unemployment rate is now at the full employment level, meaning that job opportunities are relatively abundant and wages are rising.

- The average rate for a 30-year fixed mortgage was 3.83% this week — significantly below the 5% to 6% range during the 2005 to 2007 “bubble” years.

- In fear of facing higher interest rates because of overt statements by the Federal Reserve to push rates higher in a measured fashion, demand for mortgages has increased.

- Because consumer confidence in March was at its highest level since 2000, people in general are feeling very confident about their employment prospects, their future income prospects, and the stability of the economy right now.

- The financial market composite indices are at or near all time record highs. Households owning financial assets are feeling more wealthy today than during the previous 10 years.

Click HERE for the full article.

Announcing our new monthly newsletter: Polished. Click

Announcing our new monthly newsletter: Polished. Click

The California Association of Realtors released their report on California existing home sales and median prices in July. The statewide median price rose over the 12 months ending in July by 7.1% to $464,750. Although June marked the end of the 23 months of double-digit prices increases, the median single-family home price in California has now risen on a year-over-year basis for 29 months.

The California Association of Realtors released their report on California existing home sales and median prices in July. The statewide median price rose over the 12 months ending in July by 7.1% to $464,750. Although June marked the end of the 23 months of double-digit prices increases, the median single-family home price in California has now risen on a year-over-year basis for 29 months.

According to the latest TrendGraphix reports for the beach cities for the period May 13th – July 13th compared to the same period last year you will see the number of properties for sale increased in Hermosa, Redondo and El Segundo however decreased slightly in Manhattan Beach. Although months of inventory have increased since the same time last year, we’re looking at approximately 1.9 months of available inventory for most of the beach cities including El Segundo.

According to the latest TrendGraphix reports for the beach cities for the period May 13th – July 13th compared to the same period last year you will see the number of properties for sale increased in Hermosa, Redondo and El Segundo however decreased slightly in Manhattan Beach. Although months of inventory have increased since the same time last year, we’re looking at approximately 1.9 months of available inventory for most of the beach cities including El Segundo.

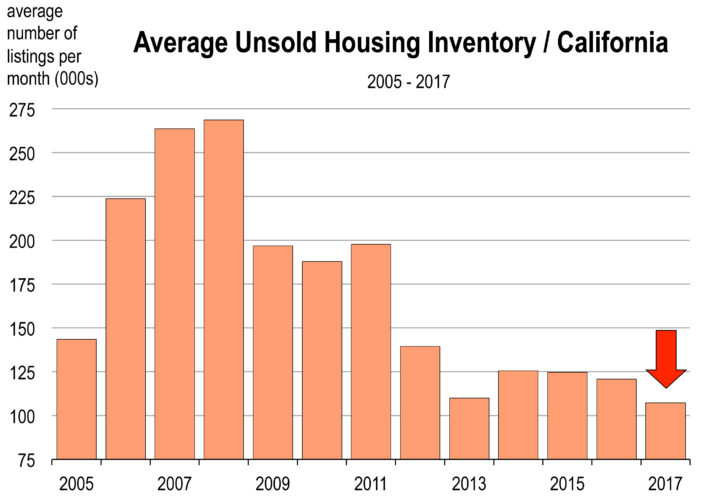

One of the oddest things about this current housing market is the dwindling amount of supply. For areas like Los Angeles and nationwide, total housing supply has been on a downward trajectory since 2010. While an environment of rising home prices, less supply, and hungry buyers would lead you to believe that more home building would be occurring, not much of that has actually happened.Though the housing market is recovering nicely, it is not doing quite as well as some analysts had predicted. There has been no shortage of excuses offered as to why this is: the rise in interest rates, more stringent lending standards, the weather. However, we feel that there is one factor that is most responsible for curtailing the number of houses sold – the number of houses available for sale!

One of the oddest things about this current housing market is the dwindling amount of supply. For areas like Los Angeles and nationwide, total housing supply has been on a downward trajectory since 2010. While an environment of rising home prices, less supply, and hungry buyers would lead you to believe that more home building would be occurring, not much of that has actually happened.Though the housing market is recovering nicely, it is not doing quite as well as some analysts had predicted. There has been no shortage of excuses offered as to why this is: the rise in interest rates, more stringent lending standards, the weather. However, we feel that there is one factor that is most responsible for curtailing the number of houses sold – the number of houses available for sale!

There is very little doubt that the real estate market is on much firmer ground that it was five years ago. Along the California coast, it’s not merely challenging to find reasonably priced real estate – it’s nearly impossible. Home values are rapidly rising and a confluence of factors will likely continue to drive the market even higher. Pent-up demand, job growth and still-slow mortgage rates continue to put pressure on home prices. The median price of a home in Los Angeles County rose by 5.9 percent in June, compared with the same month a year ago, while the number of homes sold dipped by 7.5 percent, a real estate information service announced today. According to DataQuick, the median price of a Los Angeles County home was $450,000 last month, up from $425,000 in June 2013. A total of 6,792 homes were sold in the county, down from 7,342 during the same month the previous year. In many markets price appreciation has slipped into the more sustainable single-digit range, compared with gains exceeding 20 percent this time last year. Home values are rrising and a confluence of factors will likely continue to drive the market even higher. Consider the following:

There is very little doubt that the real estate market is on much firmer ground that it was five years ago. Along the California coast, it’s not merely challenging to find reasonably priced real estate – it’s nearly impossible. Home values are rapidly rising and a confluence of factors will likely continue to drive the market even higher. Pent-up demand, job growth and still-slow mortgage rates continue to put pressure on home prices. The median price of a home in Los Angeles County rose by 5.9 percent in June, compared with the same month a year ago, while the number of homes sold dipped by 7.5 percent, a real estate information service announced today. According to DataQuick, the median price of a Los Angeles County home was $450,000 last month, up from $425,000 in June 2013. A total of 6,792 homes were sold in the county, down from 7,342 during the same month the previous year. In many markets price appreciation has slipped into the more sustainable single-digit range, compared with gains exceeding 20 percent this time last year. Home values are rrising and a confluence of factors will likely continue to drive the market even higher. Consider the following: