Investors Are Leading the Way in Real Estate Market

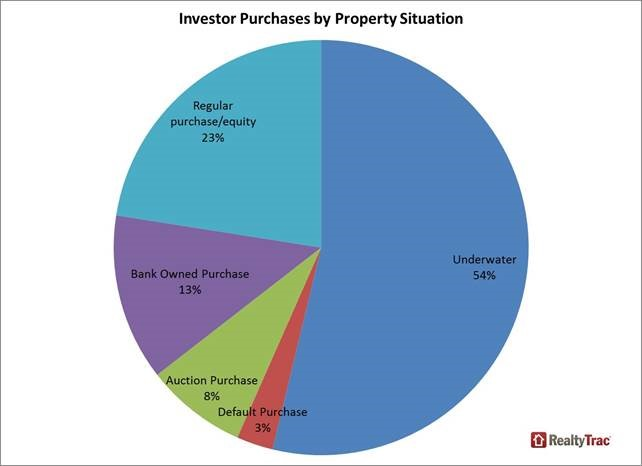

Blog, Market Updates, Real Estate News, Real Estate Tips | Dunham Stewart Though most real estate market observers have been predicting that rising home prices would drive investors out of the market for single family homes, that fact is that investors have purchased more homes than they did in all of 2012 or 2011. Investors have purchased more than 370,000 properties so far in 2013, which is already more than in either of the previous two full years according to a new investor insight report released today by RealtyTrac. The Real Estate Investor Purchase and Finance Patterns: 2011 to 2013, looks at a number of investor habits relating to real estate purchases since 2011, including the volume of properties purchased, breakdown of cash versus financed purchases, property situation (distressed, non-distressed, underwater etc.), investor purchases by property value, and number of investor-purchased properties that have since resold. A couple of interesting findings 1) Investors have purchased more than $1 trillion in US real estate since 2011. Fifty-four percent were all-cash; 2) Among all investor purchases during the time period, 57 percent have subsequently been re-sold. The smart money still sees the real estate market as a solid long term investment.

Though most real estate market observers have been predicting that rising home prices would drive investors out of the market for single family homes, that fact is that investors have purchased more homes than they did in all of 2012 or 2011. Investors have purchased more than 370,000 properties so far in 2013, which is already more than in either of the previous two full years according to a new investor insight report released today by RealtyTrac. The Real Estate Investor Purchase and Finance Patterns: 2011 to 2013, looks at a number of investor habits relating to real estate purchases since 2011, including the volume of properties purchased, breakdown of cash versus financed purchases, property situation (distressed, non-distressed, underwater etc.), investor purchases by property value, and number of investor-purchased properties that have since resold. A couple of interesting findings 1) Investors have purchased more than $1 trillion in US real estate since 2011. Fifty-four percent were all-cash; 2) Among all investor purchases during the time period, 57 percent have subsequently been re-sold. The smart money still sees the real estate market as a solid long term investment.

Existing-home sales increased in August, reaching their highest level in 6 1/2 years. What’s more, the median price shows nine consecutive months of double-digit year-over-year increases, according to the National Association of REALTORS®. Sales are at the highest pace since February 2007, when they hit 5.79 million, and have remained above year-ago levels for the past 26 months. The median time on market for all homes was 43 days in August, little changed from 42 days in July, but is much faster than the 70 days on market in August 2012. Total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. Unsold inventory is 6.3 percent below a year ago, when there was a 6-month supply. Limited inventory in some areas means multiple bidding remains a factor; 17 percent of all homes sold above the asking price in August. As the equity position of most homeowners continues to improve, some who have been on the sidelines will list their home for sale. Current home owners—whether move-up, move-down, or move-over buyers—accounted for nearly 45 percent of the market share in home sales. Meanwhile, first-time home buyers are still being held back, with a slight drop in their market share from 36 percent to 35.7 percent month over month. The investor share in home purchases dropped to 19.7 percent from 23.1 percent.

Existing-home sales increased in August, reaching their highest level in 6 1/2 years. What’s more, the median price shows nine consecutive months of double-digit year-over-year increases, according to the National Association of REALTORS®. Sales are at the highest pace since February 2007, when they hit 5.79 million, and have remained above year-ago levels for the past 26 months. The median time on market for all homes was 43 days in August, little changed from 42 days in July, but is much faster than the 70 days on market in August 2012. Total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. Unsold inventory is 6.3 percent below a year ago, when there was a 6-month supply. Limited inventory in some areas means multiple bidding remains a factor; 17 percent of all homes sold above the asking price in August. As the equity position of most homeowners continues to improve, some who have been on the sidelines will list their home for sale. Current home owners—whether move-up, move-down, or move-over buyers—accounted for nearly 45 percent of the market share in home sales. Meanwhile, first-time home buyers are still being held back, with a slight drop in their market share from 36 percent to 35.7 percent month over month. The investor share in home purchases dropped to 19.7 percent from 23.1 percent.

The proportion of investors involved in the housing market has fallen in the last few months. As their numbers dwindle, it may allow other buyers to step in, according to housing experts.In recent years, many buyers—particularly first-time home buyers—may have lost out to investors’ all-cash offers on homes. Banks and sellers may have been lured by the idea of a quick deal that cash offers typically provide over offers from buyers who require financing. But with less competition from investors, some housing experts say this may allow an opportunity for other potential buyers to get into the market. Investors have gone from accounting for 23 percent of home purchases in February to about 20 percent in June—the lowest level since September 2012, according to data from Campbell/Inside Mortgage Finance survey. With mortgage rates rising in anticipation of the

The proportion of investors involved in the housing market has fallen in the last few months. As their numbers dwindle, it may allow other buyers to step in, according to housing experts.In recent years, many buyers—particularly first-time home buyers—may have lost out to investors’ all-cash offers on homes. Banks and sellers may have been lured by the idea of a quick deal that cash offers typically provide over offers from buyers who require financing. But with less competition from investors, some housing experts say this may allow an opportunity for other potential buyers to get into the market. Investors have gone from accounting for 23 percent of home purchases in February to about 20 percent in June—the lowest level since September 2012, according to data from Campbell/Inside Mortgage Finance survey. With mortgage rates rising in anticipation of the  Remember when kids couldn’t wait to move out of their parents’ house? Well those days are over. Once they have graduated from college, how soon should your children be out of the house and living on your own? The younger parents are more forgiving of their kids living at home post-college than older parents. Overall, 20 percent of Americans say it’s OK for adult children to live at home as long as they want, while 13 percent said it’s never OK to live at home with mom and dad after college, according to the study. “In terms of transitioning into independent adulthood, it’s almost as if 27 is the new 18,” said psychotherapist Dr. Robi Ludwig. “Living at home can be a great opportunity for young adults who need some time to get on their feet, but it’s only beneficial if the time is used wisely. Our twenties are a very crucial time because the decisions we make and the lessons we learn then influence who we become as adults.” Not only do these boomerang kids think it’s okay to hunker down with mom and dad, but many of them are actually doing so.Trulia recently released a survey showing that 44% of jobless 18 to 34 year-olds live with their parents, while nearly a quarter of those with jobs have yet to leave the nest. The problem is that all of those 20- and 30-somethings living at home has weighed on the housing market’s recovery. With little-to-no track record paying rent or establishing the credit they need for a mortgage,there are fewer first-time homebuyers entering the market. And that seems to be having an impact. Homeownership, at 65%, is at its lowest level since 1995, according to a recent report from the Census Bureau.

Remember when kids couldn’t wait to move out of their parents’ house? Well those days are over. Once they have graduated from college, how soon should your children be out of the house and living on your own? The younger parents are more forgiving of their kids living at home post-college than older parents. Overall, 20 percent of Americans say it’s OK for adult children to live at home as long as they want, while 13 percent said it’s never OK to live at home with mom and dad after college, according to the study. “In terms of transitioning into independent adulthood, it’s almost as if 27 is the new 18,” said psychotherapist Dr. Robi Ludwig. “Living at home can be a great opportunity for young adults who need some time to get on their feet, but it’s only beneficial if the time is used wisely. Our twenties are a very crucial time because the decisions we make and the lessons we learn then influence who we become as adults.” Not only do these boomerang kids think it’s okay to hunker down with mom and dad, but many of them are actually doing so.Trulia recently released a survey showing that 44% of jobless 18 to 34 year-olds live with their parents, while nearly a quarter of those with jobs have yet to leave the nest. The problem is that all of those 20- and 30-somethings living at home has weighed on the housing market’s recovery. With little-to-no track record paying rent or establishing the credit they need for a mortgage,there are fewer first-time homebuyers entering the market. And that seems to be having an impact. Homeownership, at 65%, is at its lowest level since 1995, according to a recent report from the Census Bureau.

When it comes to the economy and the Federal Reserve, do you believe economic abstractions or job creators? This has been a hard-to-read recovery, leading the central bank to err on the side of doing more rather than less. The Federal Reserve has held its ground on maintaining its stimulus program. They have recently announced that it will continue purchasing $85 billion in bonds each month — at least for now. The Fed’s bond-purchasing program has helped move mortgage rates to their lowest levels on record in recent months. However, the Fed has signaled that the program would likely come to an end soon, causing a shift upward in mortgage rates. “We have seen recent up tick in mortgage rates — which almost certainly is due to market expectations of tapering in the near future and may have influenced the Fed in not changing its guidance,” Econoday analysts said. The economy added 200,000 new jobs last month, 20,000 of which were construction jobs due to an upswing in housing. The job growth could point to less need for the bond-purchasing program. Federal Reserve chairman Ben Bernanke has made recent comments that a slowdown in bond-buying could begin some time this year.

When it comes to the economy and the Federal Reserve, do you believe economic abstractions or job creators? This has been a hard-to-read recovery, leading the central bank to err on the side of doing more rather than less. The Federal Reserve has held its ground on maintaining its stimulus program. They have recently announced that it will continue purchasing $85 billion in bonds each month — at least for now. The Fed’s bond-purchasing program has helped move mortgage rates to their lowest levels on record in recent months. However, the Fed has signaled that the program would likely come to an end soon, causing a shift upward in mortgage rates. “We have seen recent up tick in mortgage rates — which almost certainly is due to market expectations of tapering in the near future and may have influenced the Fed in not changing its guidance,” Econoday analysts said. The economy added 200,000 new jobs last month, 20,000 of which were construction jobs due to an upswing in housing. The job growth could point to less need for the bond-purchasing program. Federal Reserve chairman Ben Bernanke has made recent comments that a slowdown in bond-buying could begin some time this year.

Home prices have regained nearly half of the value lost since prices peaked in June 2006 and prices rose 1.5 percent last month and 4.5 percent above January prices. Existing-home sales in the West increased 2.5 percent to a pace of 1.23 million in May and are 7.0 percent above a year ago. With the tightest regional supply, the median price in the West was $276,400, up 19.9 percent from May 2012, according to the National Association of Realtors. Sales have stayed above year-ago levels for 23 months, while the national median price shows 15 consecutive months of year-over-year increases. The same rising prices that are boosting inventories also drove investors out of the market, according to the latest Campbell/Inside Mortgage Finance HousingPulse Tracking Survey. The investor share of home purchases tumbled from 22.0 percent in April to 20.2 percent in May based on a three-month moving average. That was the sharpest drop in investor activity recorded in more than three years. According to NAR, Individual investors purchased 18 percent of homes in May; they were 19 percent in April. Both current homeowners and first-time homebuyers increased their participation in the home purchase market between April and May. Current homeowners accounted for 43.8 percent of home purchases last month while first-time homebuyers represented 36.0 percent in May, HousingPulse results showed.

Home prices have regained nearly half of the value lost since prices peaked in June 2006 and prices rose 1.5 percent last month and 4.5 percent above January prices. Existing-home sales in the West increased 2.5 percent to a pace of 1.23 million in May and are 7.0 percent above a year ago. With the tightest regional supply, the median price in the West was $276,400, up 19.9 percent from May 2012, according to the National Association of Realtors. Sales have stayed above year-ago levels for 23 months, while the national median price shows 15 consecutive months of year-over-year increases. The same rising prices that are boosting inventories also drove investors out of the market, according to the latest Campbell/Inside Mortgage Finance HousingPulse Tracking Survey. The investor share of home purchases tumbled from 22.0 percent in April to 20.2 percent in May based on a three-month moving average. That was the sharpest drop in investor activity recorded in more than three years. According to NAR, Individual investors purchased 18 percent of homes in May; they were 19 percent in April. Both current homeowners and first-time homebuyers increased their participation in the home purchase market between April and May. Current homeowners accounted for 43.8 percent of home purchases last month while first-time homebuyers represented 36.0 percent in May, HousingPulse results showed.

You’ve heard of days on market for a listing? How about a year on market for buyers? A new survey found that one out of three buyers has been looking for a home for more than a year and now they are ready to grovel. The survey found that one third of buyers currently searching for a home have been on the hunt for more than a year, and that the vast majority of them are willing to negotiate with sellers and make compromises to find their next home. With prices rising every week, lenders as strict as ever, interest rates rising, inventories at decade-low levels and competition for homes breaking their hearts, more and more buyers are reaching their frustration limits. In particular, prospective homebuyers are willing to compromise on popular amenities and their home’s location. Listed inventory in April was approximately 14 percent below one year earlier and 32 percent below the level of April 2011 , which has made it difficult for buyers to find homes. With an increase of buyers coming into the market, the lack of available homes for sale has presented challenges for first-time and move-up homebuyers. The recovery has transformed the mindset of many buyers and sellers who grew accustomed to the buyers’ market we saw for years. The current market trends indicate buyer confidence is building back up and demand is strong. As our survey indicates, sellers are now in a more favorable position. For the last few years, homeowners have been hesitant to list their homes due to unfavorable economic conditions. Today, the recovery in housing continues to gain momentum, and with so many buyers in the market who are competing for so few available homes, it is a great time for sellers to speak with a real estate professional about the advantages of listing their home.

You’ve heard of days on market for a listing? How about a year on market for buyers? A new survey found that one out of three buyers has been looking for a home for more than a year and now they are ready to grovel. The survey found that one third of buyers currently searching for a home have been on the hunt for more than a year, and that the vast majority of them are willing to negotiate with sellers and make compromises to find their next home. With prices rising every week, lenders as strict as ever, interest rates rising, inventories at decade-low levels and competition for homes breaking their hearts, more and more buyers are reaching their frustration limits. In particular, prospective homebuyers are willing to compromise on popular amenities and their home’s location. Listed inventory in April was approximately 14 percent below one year earlier and 32 percent below the level of April 2011 , which has made it difficult for buyers to find homes. With an increase of buyers coming into the market, the lack of available homes for sale has presented challenges for first-time and move-up homebuyers. The recovery has transformed the mindset of many buyers and sellers who grew accustomed to the buyers’ market we saw for years. The current market trends indicate buyer confidence is building back up and demand is strong. As our survey indicates, sellers are now in a more favorable position. For the last few years, homeowners have been hesitant to list their homes due to unfavorable economic conditions. Today, the recovery in housing continues to gain momentum, and with so many buyers in the market who are competing for so few available homes, it is a great time for sellers to speak with a real estate professional about the advantages of listing their home.

Housing affordability remains high despite recent reports that show home prices saw their biggest year-over-year gains in more than seven years, according to NAR’s most recent report, reflecting data from the first quarter of 2013. The NAR’s quarterly reports on median pricing are a good measure of where prices in certain markets are headed generally, but their results can sometimes overstate the magnitude of price gains. “The supply/demand balance is clearly tilted toward sellers in a good portion of the country,” said Lawrence Yun, NAR’s chief economist, in a statement. Low mortgage rates and stabilizing incomes are keeping home affordability high and giving home buyers ample buying power. Still, credit remains tight for some buyers, especially those with damaged credit scores and those who are not able to save enough for a large down payment. Prices have also risen in large part because inventories of homes for sale have plummeted. Low inventories in some markets have sparked bidding wars among buyers.

Housing affordability remains high despite recent reports that show home prices saw their biggest year-over-year gains in more than seven years, according to NAR’s most recent report, reflecting data from the first quarter of 2013. The NAR’s quarterly reports on median pricing are a good measure of where prices in certain markets are headed generally, but their results can sometimes overstate the magnitude of price gains. “The supply/demand balance is clearly tilted toward sellers in a good portion of the country,” said Lawrence Yun, NAR’s chief economist, in a statement. Low mortgage rates and stabilizing incomes are keeping home affordability high and giving home buyers ample buying power. Still, credit remains tight for some buyers, especially those with damaged credit scores and those who are not able to save enough for a large down payment. Prices have also risen in large part because inventories of homes for sale have plummeted. Low inventories in some markets have sparked bidding wars among buyers.

Only a year ago all the conversation was doom and gloom. Next we hear about the reviving housing market with talk of “green shoots”. Now it has become apparent that the real estate market is in a full upswing, with a rebound of 20% since the bottom of the downturn. However lately I have begun to hear talk of a housing bubble. Really, a housing bubble? Today’s market is driven by a shortage of supply, pent up demand and low interest rates. Not the abundant listings and lax lending standards as before. Lending standard remain stringent, and in the future the lack of easy money will act to temper any fever that may develop as prices rise. We tend to forget that real estate is cyclical. The market goes up and the market goes down. Right now the market is going up and should continue for several more years. Exactly how long is anybody’s guess.

Only a year ago all the conversation was doom and gloom. Next we hear about the reviving housing market with talk of “green shoots”. Now it has become apparent that the real estate market is in a full upswing, with a rebound of 20% since the bottom of the downturn. However lately I have begun to hear talk of a housing bubble. Really, a housing bubble? Today’s market is driven by a shortage of supply, pent up demand and low interest rates. Not the abundant listings and lax lending standards as before. Lending standard remain stringent, and in the future the lack of easy money will act to temper any fever that may develop as prices rise. We tend to forget that real estate is cyclical. The market goes up and the market goes down. Right now the market is going up and should continue for several more years. Exactly how long is anybody’s guess.

This is the year renovations make a come back according to the second annual

This is the year renovations make a come back according to the second annual